Earlier Version of Tally ERP 9

In this video we have explained how to download earlier or older version of Tally from Tally Website.Contact us on:Youtube: https://www.youtube.com/channel/U.

| Description | For Stat | For Download |

| Tally.ERP 9 Series A Release 2.1 | Stat 133 | Click here |

| Tally.ERP 9 Series A Release 2.0 | Stat 123 | Click here |

| Tally.ERP 9 Series A Release 1.82 | Stat 120 | Click here |

| Tally.ERP 9 Series A Release 1.81 | Stat 116 | Click here |

| Tally.ERP 9 Series A Release 1.8 | Stat 114 | Click here |

| Tally.ERP 9 Series A Release 1.61 | Stat 112 | Click here |

| Tally.ERP 9 Series A Release 1.6 | Stat 104 | Click here |

| Tally.ERP 9 Series A Release 1.52 | Stat 98 | Click here |

| Tally.ERP 9 Series A Release 1.51 | Stat 92 | Click here |

| Tally.ERP 9 Series A Release 1.5 | Stat 90 | Click here |

| Tally.ERP 9 Series A Release 1.3 | Stat 88 | Click here |

| Tally.ERP 9 Series A Release 1.2 | Stat 85 | Click here |

| Tally.ERP 9 Series A Release 1.1 | Stat 84 | Click here |

| Tally.ERP 9 Series A Release 1.0 | Stat 81 | Click here |

Download tally erp 9 version 8 for pc for free. Business software downloads - Tally.ERP 9 by Tally Solutions Pvt. Ltd and many more programs are available for instant and free download. Tally.ERP 9 Release 5.0 is a path-breaking innovation bringing to you the ability to. Generate 100% accurate tax returns in a matter of minutes. Synchronise your business data across locations without the need for rigid schedules. Manage your working capital requirements and plan your cash in the most efficient way. Learn how to download and activate free Tally ERP 9 License version for the next 30 days. Tally Solutions provides a free license for its GST ready tally ERP. RTS-XQuery Freemium. RTS-XQuery Freemium is a FREE Tally add-on utility that allows.

Earlier Version of Tally 9

Tally Erp 9 Download Old Version

| Description | For Stat | For Download |

| Tally 9 Release 2.14 | Stat 80 | Click here |

| Tally 9 Release 2.13 | Stat 74 | Click here |

Earlier Version of Tally 7.2 and Data Convertor

| Description | For Stat | For Download |

| Tally 7.2 Release 3.14 | Stat 62 | Click here |

| Data Converter Tally 4.5 to Tally.ERP 9 | Conversion Guide | Click here |

- Download tally erp 9 installer for free. Business software downloads - Tally.ERP 9 by Tally Solutions Pvt. Ltd and many more programs are available for instant and free download.

- Hello Friends, mera ek new channel ' @Vyangya Vani ' he. Is channel par HASYA, VYANGYA AUR FILMI SONGS PAR PARODY RELATED VIDEOS DEKHNE KO MILEGI.YE.

- On the Tally Solutions Downloads page, scroll down and click on the Install Now button in orange. This starts your download. Wait for the file to download. Once the download is complete, go to your browser’s downloads section and open the location of the downloaded file. Double click on the downloaded Tally file.

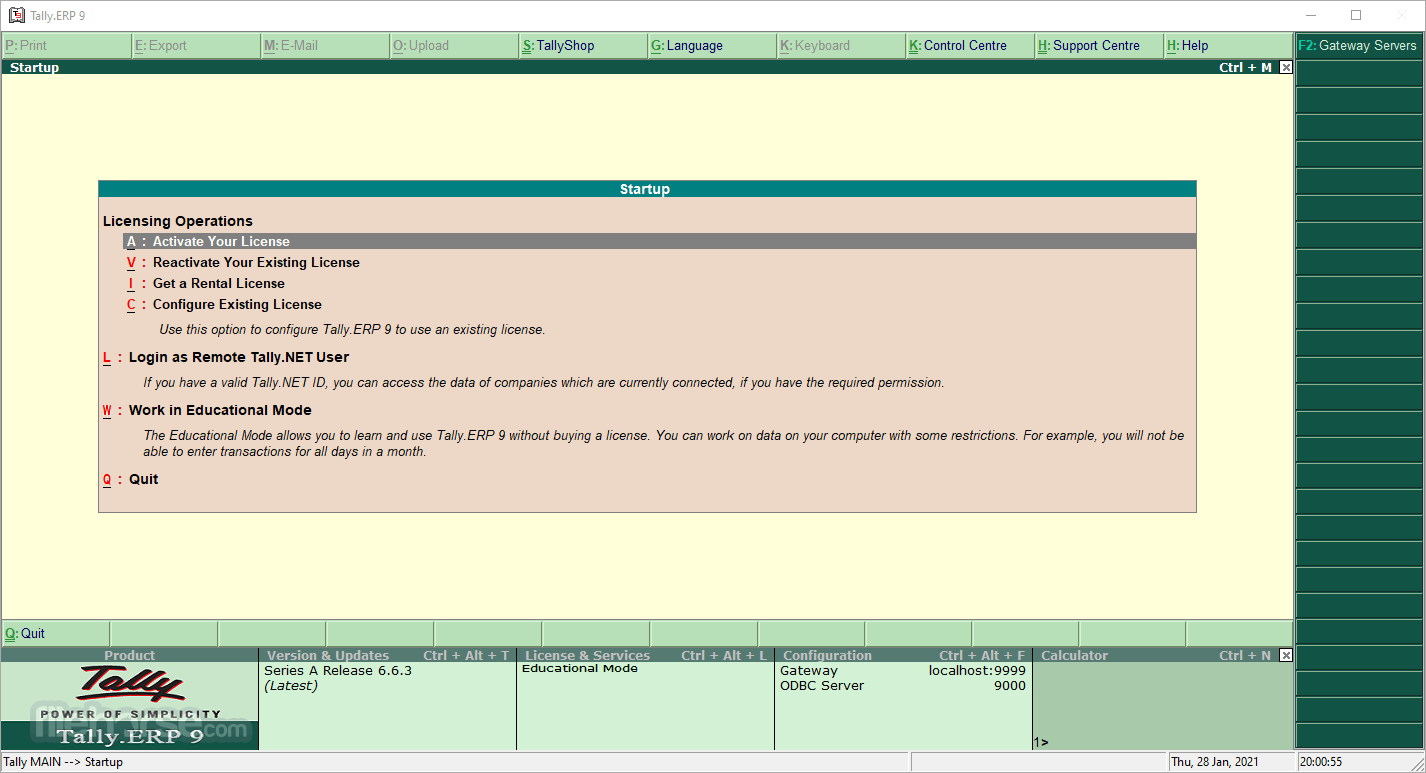

Tally is a paid Software

PDF Link: For Downloading Tally.ERP 9 - this easy Hindi tutorial for beginners, you will le. Get setup file of all versions of Tally ERP 9 free download from Tally 9 to Tally ERP 9 release 6.6.1, which is latest and most popular version of Tally ERP 9.

It needs to be purchased to legally used it

However, educational version is available free of cost which can be used for learning.

Follow the steps to download and install Tally ERP 9

- Click https://tallysolutions.com/download/

- Just Click Install

- Setup will be Downloaded

- Click Setup

- Automatically Tally Installed

- Shortcut on Desktop Appears

- Click Tally ERP 9 Icon

- If paid, Activate license or If used to learn Click Work in Educational Mode

Difference between Paid Version and Educational Version of Tally

| Paid Version of Tally | Educational Version of Tally |

All features of tally can be used |

|

License valid for 1 year after which some renewal fees to be paid | It is free of cost for learning process |

Introduction

The Goods & Services Tax (GST) has been implemented in India since 1st July 2017. Since then, the GST Council has been working to simplify the rules to make it easier for businesses. At Tally, we have walked the GST journey with our customers by continuously building a reliable GST software on par with the changes, to make compliance simpler for businesses and tax consultants.

GST means different things to different stakeholders. Businesses registered as regular dealers need to file their GSTR-1 on a monthly basis if their aggregate turnover exceeds 1.5 Cr. Businesses with an aggregate turnover less than 1.5 Cr have to do GSTR-1 return filing on a quarterly basis. Also, both businesses need to file their GSTR-3B on a monthly basis.

On the other hand, composite dealers have to file GSTR-4 on a quarterly basis. Also, going forward, as the e-Way bill becomes mandatory for interstate and intrastate movement of goods worth Rs. 50,000, businesses will have to adhere to e-Way Bill compliance as well.

All this calls for an efficient GST ready accounting software, which can not only take care of your holistic business needs but also ensure a hassle-free compliance experience.

Benefits of using Tally.ERP 9

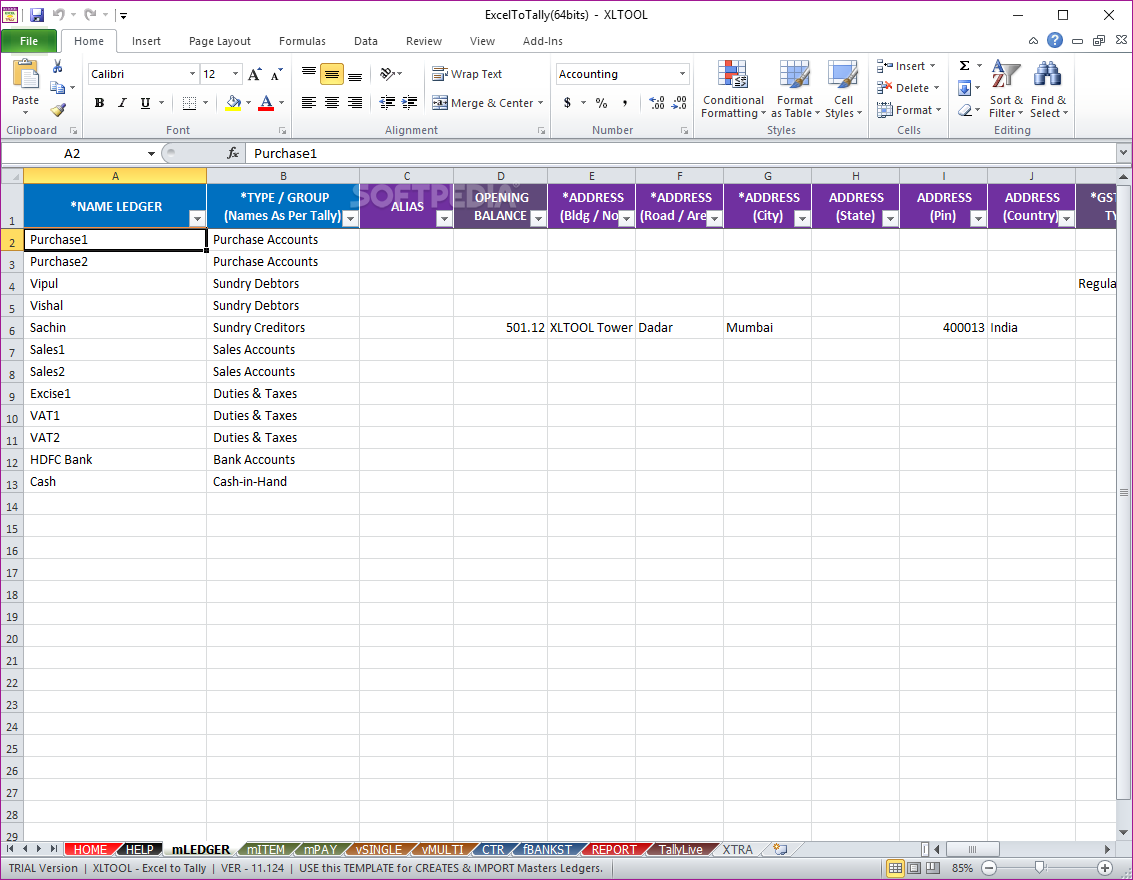

Tally is the most popular and reliable GST ready accounting software amongst businesses in India We believe it is critical to ensure that data is recorded correctly at the transaction level itself, which is the starting point. Tally.ERP 9 ensures you generate GST invoices and transactions as per the GST format.

As a business owner, you can easily share returns data with your tax consultant as per GST format. If you prefer to, you can file GSTR-1, GSTR-3B and GSTR-4 on your own by exporting data to the Excel Offline Utility tool or in JSON format as per the GST portal. The unique error detection and correction capability ensure that you file returns accurately.

Tally 6.5.5 Download

When it comes to e-Way Bills, Tally.ERP 9 helps you to easily generate and manage e-Way Bills. You can capture all the required information at invoice level itself, export the data in JSON format and upload the data in the e-Way portal to generate the e-Way Bill.

If you are a tax consultant, then you can easily share changes made in returns by marking them. The list of only the changed transactions can be shared with your clients so that they can update their books easily by replacing only the appropriate details in a single click.

Go ahead and take Tally's GST software, free download, to start your journey towards an effective GST compliance journey.

Versatility that adapts to your business needs

Hp deskjet f4230 installer free download. Tally's GST software in India handles all your GST billing needs. You can generate a range of invoices, from simple invoices to invoices with multiple items and multiple tax rates. You can also manage advance receipts, reverse charge scenarios, branch transfers, bill of supply, export invoices, input tax credit and other adjustments - all by using Tally's GST billing software.

Tally.ERP 9 ensures that your GST returns are in sync with your books of accounts, and reflect the same data as used for filing returns in the GST portal, thus proving to be the right GST return software for you.

File your GST returns accurately with Tally's GST Software

Avoid hassles of segregating data invoice-wise, detect and correct errors in transactions quickly and generate returns in the required format using Tally.ERP 9. You can generate GSTR-1, GSTR-3B and GSTR-4 either in JSON format or use the Excel Offline Utility tool to file your GST returns. To understand the product's capabilities in its entirety, feel free to use Tally's GST software free trial - and assess how your business needs are being catered to.

GST Concepts & FAQs

What is Form GSTR-3B? How do I file it?

Form GSTR-3B is an interim return form to be used by GST dealers with regular registration for filing returns for the current financial year. Learn More

If I am providing services across multiple states, can't I manage with single registration?

No. In the current regime, Service Tax was applicable for services, which required a unified, centralized registration. However, in the current regime, goods and services will have the same treatment and will be taxed on supply, at the place of supply. To understand more, please refer our blog post - Learn More.

I have VAT number, UAM number. Will that be sufficient for GST registration?

No, even for a business transitioning into GST, PAN will need to be furnished for GST registration. To understand more about the process of registration, please refer our blog post - Learn More.

What will be the fate of C Form, H Form and F Form in GST?

In the current regime, C Form is required for CST compliance during inter-state transactions; H Form is issued when the inter-state buyer is an exporter, and F Form is issued as proof of stock transfer. To know more, about all the forms refer to our post - Forms Under GST.

What is the difference between mixed and composite supply?

Composite Supply means a supply made by a taxable person to a recipient comprising two or more supplies of goods or services, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business. GST Mixed Composite Supply

Erp 9 App Download

How To Download And Install Tally Erp 9 Software Full Version For Free

Can we avail excise duty for goods purchased before 1 year?

Tally 9.0 Free Download

No, for claiming the excise duty paid against a particular invoice, the date of invoices or any other prescribed duty/tax paying documents must be within 12 months from the date of transitioning to GST. For more understanding, please refer our blog post - Learn More.

Tally Erp 9 Download Latest Version

Can we take ITC on stock lying with us before GST, on which we have paid excise?

Tally Software Download

As per the Transition Rules, those dealers who have purchased excisable goods, directly from the manufacturer / 1st stage dealer / 2nd stage dealer - will be eligible to get 100% credit of the excise paid on closing stock. Learn More.